One-click looping for crypto & RWAs

Loop anything.With one click.

Borrow and loop to amplify yield or price exposure without manual steps.

About Zona

Lend to earn. Loop with one click.

Lend and loop anything

Zona supports both crypto-native assets and RWAs. Lend and loop with a single click.

Supported Asset Types

A quick map of what you can lend and loop.

Exposure

Crypto-native

Exposure

Blue-chips

Large-cap tokens with deep liquidity.

Price

Examples: BTC, ETH

Yield-bearing stablecoins

Stable collateral for onchain strategies.

Yield

Examples: USDe, USDai

Liquid staking tokens

Staked token collateral.

Yield

Examples: stETH, rETH

Perp DEX LP positions

Liquidity positions used as collateral.

Yield

Examples: GLP, GM

Volatile assets

High-volatility tokens.

Price

Examples: Memecoins

Real-World Assets

Exposure

Equities & ETFs

Tokenized equities and indexes.

Price

Examples: NVDA, TSLA, S&P 500

Tokenized treasuries

Tokenized government debt.

Yield

Examples: T-bills

Gold & commodities

Commodity-linked collateral.

Price

Examples: Gold, silver, oil

Real estate

Property-linked collateral.

PriceYield

Examples: Real estate funds

Frequently Asked Questions

What is Zona?

Zona is a one-click looping protocol for both RWAs and crypto-native assets. With a single click, you can borrow and loop to get boosted price exposure, boosted yield, or both - without doing manual steps across multiple protocols.

What is one-click looping?

One-click looping means we bundle the steps to getting leveraged price exposure or leveraged yield into one guided flow:

1. Deposit collateral

2. Borrow against it

3. Swap and re-deposit

Repeating this increases your position size. If the position earns yield, your yield can scale with position size - and if the asset moves, your price exposure scales too.

What are Zona's core products?

Zona consists of two core products:

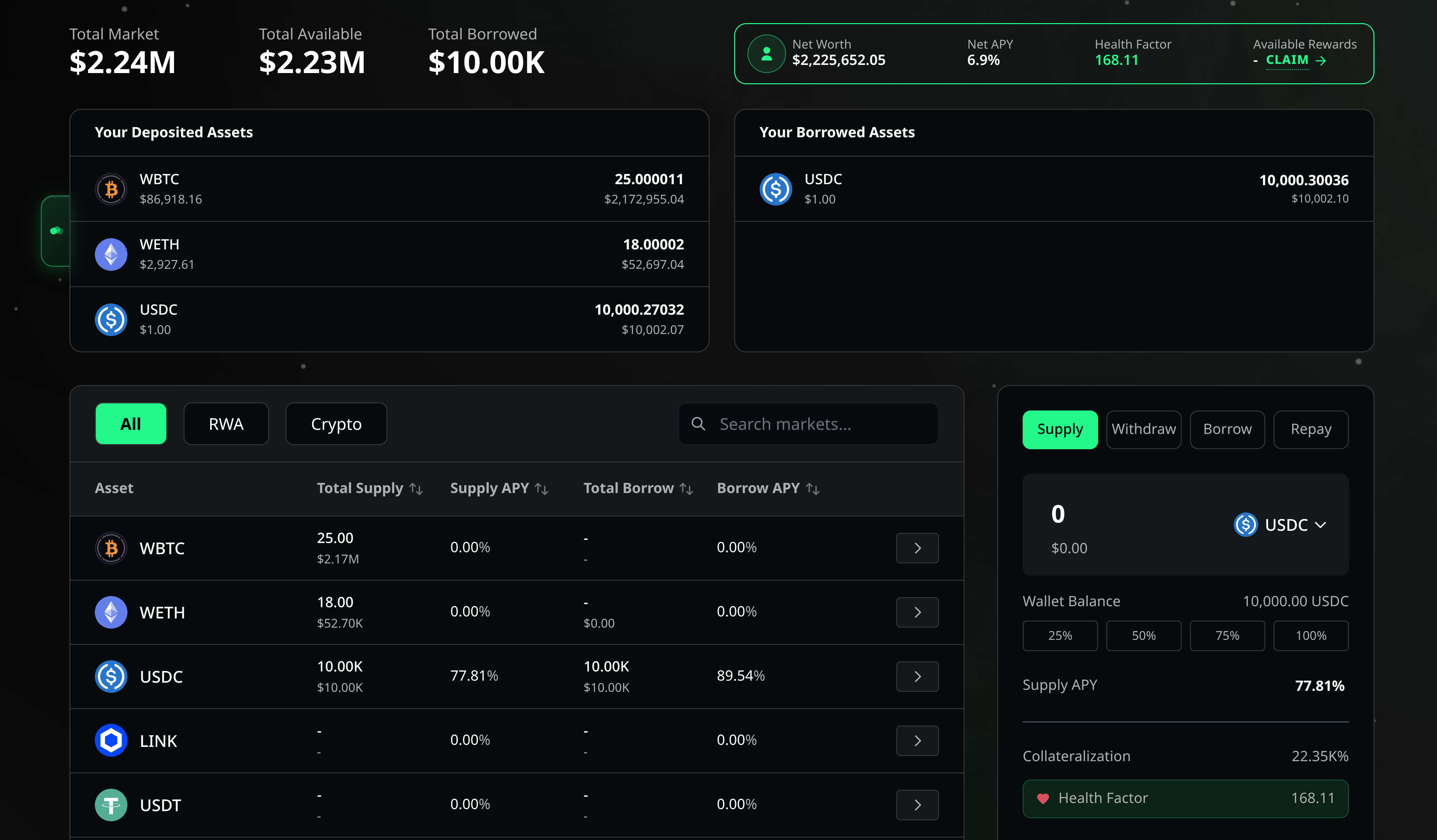

1. ZonaLend: our underlying lending/borrowing platform that provides liquidity for looping. You can also use it like a normal lending market (deposit, borrow) without looping. Deposit RWAs or crypto-native assets as collateral, then borrow against them.

2. ZonaLoop: one-click looping to get leveraged price exposure, leveraged yield, or both. Simply input your desired collateral, position size, and leverage - ZonaLoop handles the loop steps automatically.

What assets does Zona support?

Zona supports both RWAs and crypto-native assets. Asset listing depends on network support, liquidity, and oracle reliability.

1. RWA: treasuries, equities, ETFs, tokenized gold, commodities, real estate, and more.

2. Crypto: liquid staking tokens, perpetual exchange LP positions, yield-bearing stablecoins, memecoins, and more.

How do I contact the team?

Join our Discord and talk with us in #general. For private discussions, please open a ticket in #tickets. We usually respond fastest there.